Despite a 39 percent drop in net profit to 164 million dollars in 2024, SunExpress CEO Max Kownatzki described the year as a “record profit.”

SunExpress, the joint venture between Turkish Airlines (THY) and Lufthansa, presented its 2024 performance results and 2025 outlook at a press conference in Istanbul. However, CEO Max Kownatzki’s statement highlighting a “record profit” raised eyebrows, as it contradicted the company’s published financial data.

In 2024, the airline carried 15 million passengers, marking the highest annual passenger volume in its history. It also achieved a 23% year-on-year revenue increase, reaching €2.2 billion. Yet, the net income figures painted a different picture.

Net profit fell 39% from previous year

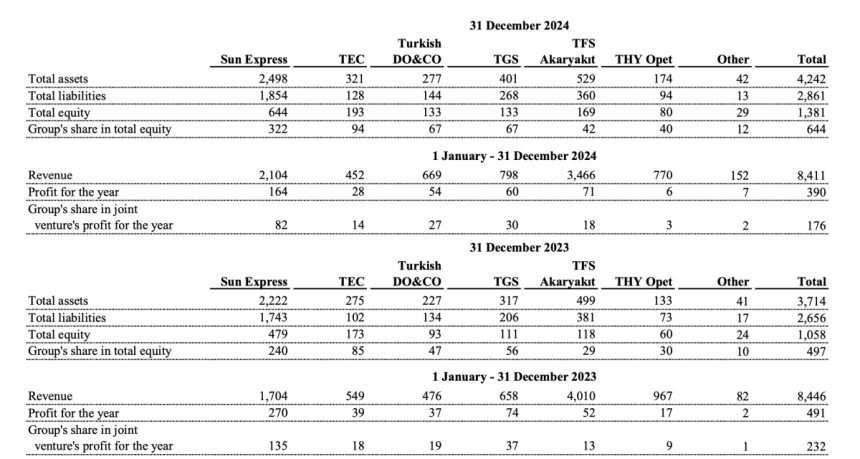

SunExpress posted a net profit of $164 million in 2024, down from $270 million in 2023—a decline of 39%, or $106 million. The sharp decrease was also clearly reflected in Turkish Airlines’s consolidated financial reports.

Speaking at the event, CEO Kownatzki said, “Thanks to our strong financial performance, efficient operations, and the high-quality service we offer to our passengers, we had a very successful year. In 2024, we achieved record growth in both capacity and fleet expansion, reaching the highest revenue and profit in our company’s history.”

Previously reported by Haber Aero

The 39% decline in net income highlights key challenges faced by SunExpress in 2024—including intensified post-pandemic competition, rising operational costs, and inflation-related accounting impacts. The airline also emerged as the second-largest profit-losing subsidiary under Turkish Airlines (THY) after THY Opet.

RELATED NEWS:

- SunExpress profit plunges 39 percentage in 2024!

- THY iştiraklerinde kâr düşüşü: THY Opet ve SunExpress zirvede

The key metric is the net profit

In high-expense sectors like aviation, net profit is widely considered the most reliable indicator of financial sustainability. While revenue reflects business activity, net profit shows actual retained earnings. Despite some companies emphasizing revenue growth, financial analysts and investors typically focus on bottom-line profitability.

Bu gönderi kategorisi hakkında gerçek zamanlı güncellemeleri doğrudan bildirim almak için tıklayın.